TAX: It’s not what you make, it’s what you keep.

- fenwick136

- Mar 3, 2023

- 6 min read

Updated: Jun 14, 2023

Firstly, I want to acknowledge some great feedback, like a request for more discussion on the creation of "passive income". Its truly appreciated so please keep it coming no matter how large, small, or ugly! It’ll continue helping me steer these posts in the direction of what is going to add the most value to all.

"Your most unhappy readers, are your greatest source of learning."

Considering the above comment, it spurred thinking. The quickest, most effective, and risk-free approach to increasing your investment income with the least effort, is to reduce the tax bill. How convenient with a just a month of the tax year left. So that’s where we must start.

The UK tax year ends (5th April), so there are no excuses. No last minute "oh it’s too late", "I didn’t know", "I'll do it next year". Tax benefits die at the end of every year. If you don’t use them, you lose them forever. In most cases, like for ISAs, a yearly allowance that’s utilised will last a lifetime. Imagine the cost of losing decades of compounding. It's more important than paying down a mortgage.

“My wealth has come from a combination of living in America, some lucky genes, and compound interest.” Warren Buffett

"Boring investments are usually the best long term." - so invest some time levelling up your tax knowledge and watch the pay off in your bank account.

"You can't build a great building on a weak foundation."

I lived in the middle east for 9 years with zero-rate income tax. The naked eye sees a 40-50% tax saving, and yet your bank account shows 100% more incoming cash each month vs the UK equivalent. Tax is one of the biggest barriers to financial freedom.

If you can’t move to a tax haven, then let’s look at some tools we can use to shelter our investments...

Random Fact of the week: As per the Office of National Statistics, Monday is the most common day for suicide. So, read these posts over the weekend, develop abundance in both funds and philosophy, and stay away from bridges on your way to work!

The problem:

Complaining about paying taxes is not going to help. Moaning about the governments use of funds won’t help. Focussing on the stresses of the nation’s budget deficit and national debt won’t help either. All these things are out of our control and waste precious energy.

The problem is that people use complaints and the complexities of tax jargon as an excuse to avoid educating themselves and utilizing tax benefits.

Let’s not tolerate this and put the first bricks in the wall. Tax is a complex subject, for good reason (So the rich can pay less!), so we'll start with focus on basic investment income.

"Poor people often get angry when they learn rich people pay less in taxes. Instead, they should focus on learning from the rich as they pay fewer taxes legally. The poor and middle class will always pay more taxes than the rich."

Investing in a tax efficient way will help us make the most out of our money and maximise returns. Here are 4 of the best and quickest ways to level up:

1. Use your ISA allowance - For me, this is the most important!

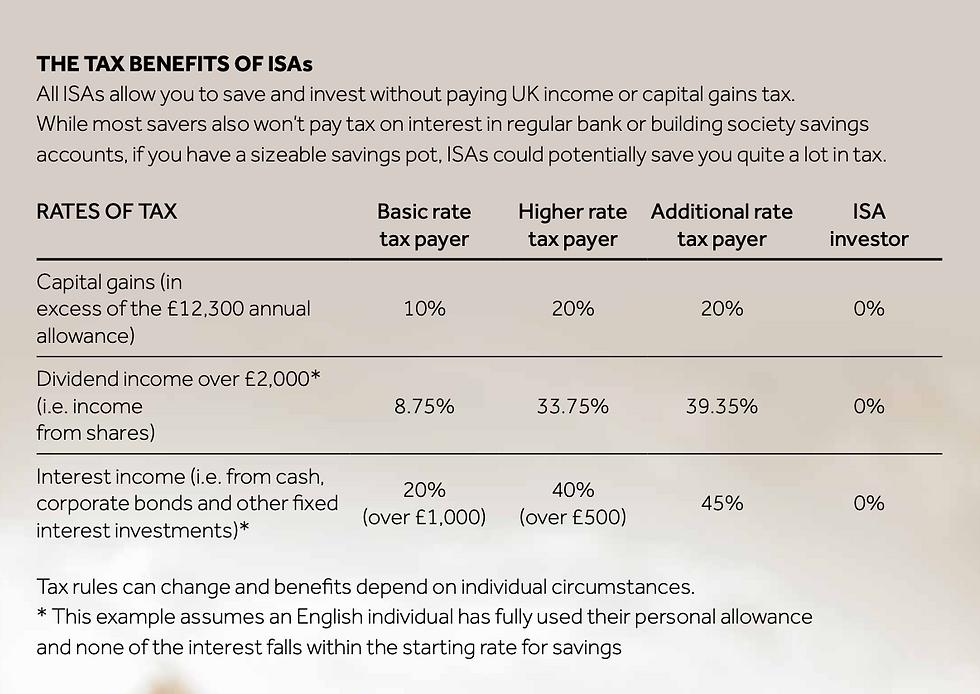

An ISA, or Individual Savings Account, is a tax-free savings and investment account that allows you to save up to a certain amount each year without paying tax on the interest or gains you earn. The annual ISA allowance for the 2022/23 tax year is £20,000. You can invest this amount in a cash ISA, stocks and shares ISA, Lifetime ISA, innovative finance ISA, or a combination of the four.

If you’re new to investing, a stocks and shares ISA is a great place to start. This type of ISA allows you to invest in a range of stocks and shares, including individual company shares, funds, and investment trusts. With a stocks and shares ISA, you can also benefit from tax-free dividends and capital gains.

2. Consider a SIPP

A SIPP, or Self-Invested Personal Pension, is a type of pension that allows you to invest in a wide range of assets, including stocks, shares, bonds, and property. The money you contribute to a SIPP is tax-free, and you can claim tax relief on your contributions, which can boost your savings.

With a SIPP, you can also benefit from tax-free growth on your investments, and when you reach retirement age, you can withdraw up to 25% of your savings tax-free. Any withdrawals beyond the 25% limit will be taxed at your marginal rate of income tax.

3. Use your Capital Gains Tax allowance.

Capital Gains Tax (CGT) is a tax on the profits you make when you sell certain assets, such as shares or property. However, everyone has a CGT allowance, which means you can make a certain amount of gains each year without paying tax.

For the 2022/23 tax year, the CGT allowance is £12,300. So, if you make gains of less than this amount in a tax year, you won’t have to pay any CGT. If you’re investing in shares, for example, you could sell a certain amount each year to make use of your CGT allowance and avoid paying tax.

4. Invest in EIS and VCTs

The Enterprise Investment Scheme (EIS) and Venture Capital Trusts (VCTs) are government-backed schemes designed to encourage investment in small, high-risk companies. Both EIS and VCTs offer generous tax relief to investors, making them an attractive option for those looking to invest in high-growth companies.

With EIS, you can claim up to 30% tax relief on your investment, while with VCTs, you can claim up to 30% income tax relief on investments up to £200,000 per tax year. However, it’s important to note that these investments come with a higher level of risk, so you should only invest money you can afford to lose.

Investing can become complex, and tax-efficient investing even more so. If you’re not confident in making investment decisions, it’s worth seeking the advice of a financial advisor. A financial advisor can help you understand the different investment options available and help you create a tax-efficient investment strategy that meets individual needs.

A call to Action:

For me, since returning to the UK I have prioritised maxing my yearly ISA allowance before making any other investment or outlay. This has already saved thousands of pounds in taxes (on dividends and capital gains) and means I can freely sell and buy different assets inside the accounts to change allocations without tax liability. I use discipline to max the ISA allowance every year and invest immediately in April to get them working.

I set up 4 different providers (Fidelity, Charles Stanley Direct, IWEB, and Interactive Investor) to increase the variety of assets I have access too. As those accounts have grown, I realise its more cost effective to build larger accounts with fixed fee providers. Across these accounts I have the flexibility to invest in any asset class. These accounts can grow, compound, and create income for life, tax free.

For short-term trading accounts I use spread betting accounts (for example IG markets, or CMC markets), which are not subject to UK tax as are considered "speculative betting" rather than investments. This allows me to both trade tax free on long and short positions. It also provides a tool to hedge taxable investment accounts rather than sell profitable positions that incur liability. The accounts also provide leverage to hedge larger positions with lower capital. A useful tool when used diligently, and yet one that needs to be used with care given the nature of margin trading.

To avoid capital gains tax, when needed, I sell loss-making positions in taxable accounts to reduce the yearly taxable gains. It's called tax loss harvesting.

The goal is to migrate as much capital to tax-efficient accounts over time as possible, so that when I want the income it will be paid gross. The largest tax efficiencies can be made through the corporate structure which we'll tackle in greater detail as we grow here.

Finally, I'm sorry if tax as a subject is not the most exciting for a weekly post. That said, 80% of the people I asked do not max their ISA, and 50% don’t even have one. Whats more worrying is that 50% of those people actually work in Banking. All are in the top 10% of salary earners in the UK. So wake up, make it a must, and get moving! I see it as giving away free money, and one of the costliest mistakes in personal finance to miss out on.

Note: with budget changes, tax benefits are decreasing as the years go by. The government needs the money! Next year, dividend relief drops to £1,000 (from £2,000), and then to just £500 in 2024. Capital gains tax drops to £6,000 (from 12,300 - ouch!), and then to £3,000 in 2024. Make the use of them now.

Incase, you have 40 seconds to be entertained by Andrew Tate telling us how Nike avoid paying taxes:

If you have 11 minutes to listen to more detailed explanation from CNBC, of how Amazon, Nike, and FedEX avoid taxes:

Followers complain, Leaders take action. So let's delve deeper as we grow!

How are you creating tax efficiency with your investments and beyond? Message me.

The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Comments